Strong hold signal today. System remains in cash, waiting for the next move. Something drastic would have to happen this afternoon for that move to come today. I will post prior to the close only if anything changes.

And that will wrap up the month of February. A solid month overall with a gain of 7.39%.

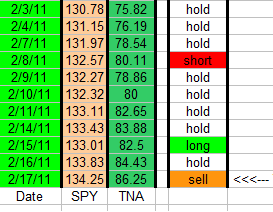

Feb Trades

Jan 27 - Sell - 75.09

Jan 28 - Hold

Jan 31 - Hold

Feb 01 - Hold

Feb 02 - Hold

Feb 03 - Hold

Feb 04 - Hold

Feb 07 - Hold

Feb 08 - Short - 80.11

Feb 09 - Hold

Feb 10 - Hold

Feb 11 - Hold

Feb 14 - Hold

Feb 15 - Buy - 82.50

Feb 16 - Hold

Feb 17 - Sell - 86.25

Feb 18 - Hold

Feb 22 - Buy - 79.96

Feb 23 - Buy - 75.85

Feb 24 - Hold

Feb 25 - Sell - 82.44

Feb 28 - Hold

Monday, February 28, 2011

Saturday, February 26, 2011

Bearish thoughts...

The first image below is of the weekly SP500. Notice the bearish outside reversal bars. The first back in late April and then the most recent one. Very similar looking if you ask me. The second image shows the signals produced by my system. I should mention when the dates are colored green, the market is considered to be healthy. When it's red, the system is in "unhealthy" mode. Depending on the mode, different code is used to generate signals. When healthy, the system will mostly buy the dips. When unhealthy, it will primarily sell or short rallies. The column on the left shows what happened in April. On the 27th, the market tanked and became unhealthy. As is typical when the market has been in a strong uptrend and is undergoing a topping process, it snapped back up quickly by the 29th, but the damage had been done. Consider the similarities to the most recent action. Longs were produced both days the market flipped to unhealthy. The market bounced 2 days later on both occurrences, and sell signals were generated. That brings us to where we are now. If the similarities continue, we might see some whipsaw action this coming week, with the trend turning downward. Any more strength, and we will probably see a short signal. Of course, there is a chance we'll go up and test the most recent highs, but odds are slightly better that we've seen at least a short term (or even intermediate term) top.

Click to enlarge...

Click to enlarge...

Friday, February 25, 2011

Sell signal

3:45pm: Sell signal is a lock. Selling my TNA on the close and going to the sidelines (100% cash) for the weekend. I may have an interesting post this weekend. Check back sometime... Have a good one!

Earlier thoughts...

It appears the system has successfully navigated the market pullback, relatively speaking anyway. Sure it could've been better, but I'll take it. I'm getting a sell signal right now. We'll see if it holds into the close. There will not be a "short" signal today, as the system sees too much risk of this rally going higher. Although personally, I don't think it will. I think we see another move downward before taking a legitimate stab at the recent highs. Fortunately, what I think doesn't matter. In fact I built this system so I don't have to think.... mainly because thinking cost me too much money in years past. :)

Earlier thoughts...

It appears the system has successfully navigated the market pullback, relatively speaking anyway. Sure it could've been better, but I'll take it. I'm getting a sell signal right now. We'll see if it holds into the close. There will not be a "short" signal today, as the system sees too much risk of this rally going higher. Although personally, I don't think it will. I think we see another move downward before taking a legitimate stab at the recent highs. Fortunately, what I think doesn't matter. In fact I built this system so I don't have to think.... mainly because thinking cost me too much money in years past. :)

Thursday, February 24, 2011

Wednesday, February 23, 2011

Buy #2 confirmed.

A 2nd buy signal was issued today. I increased my long position... and the system's average price is now lowered to 77.90 for the sake of performance stats. One glaring negative is that the market's extreme weakness the past 2 days has forced my model into "unhealthy" mode, and when that happens, it's almost never a good thing. There is an 88% chance of a lower close within the next week. So, only a 12% chance today was the short term bottom. At this point, I'm cautiously long but will be using any bounce we get to exit to safety.

Tuesday, February 22, 2011

Buy confirmed!

VIX

Look at the similarities between today and Apr 27. Bollinger bands were/are extremely narrow indicating a possible big move coming. VIX closed well above upper BB. TNA closed Apr 27 about 5 pts off its recent high at about 65. Two days later on the 29th, it was back up near the highs at 69.50. That turned out to be a great exit point before the flash crash. If I had to guess, I would say something similar will happen, which is why I fully expect the buy signal today to be profitable sometime this week. Overcome the fear and join me on the long side for a few days...

11:35am: Wow, I'm amazed... this market does know how to go down!!! We are on track for a buy signal at the close today. I will update prior to 4pm, but it's a strong buy so I doubt it will change.

Look at the similarities between today and Apr 27. Bollinger bands were/are extremely narrow indicating a possible big move coming. VIX closed well above upper BB. TNA closed Apr 27 about 5 pts off its recent high at about 65. Two days later on the 29th, it was back up near the highs at 69.50. That turned out to be a great exit point before the flash crash. If I had to guess, I would say something similar will happen, which is why I fully expect the buy signal today to be profitable sometime this week. Overcome the fear and join me on the long side for a few days...

11:35am: Wow, I'm amazed... this market does know how to go down!!! We are on track for a buy signal at the close today. I will update prior to 4pm, but it's a strong buy so I doubt it will change.

Friday, February 18, 2011

Hold

3:22pm: The short was a decent intraday signal, but now I'm getting a "hold". So the system will remain out of the market through the extended weekend.

11:18am: System is spewing out a short signal. Let 'er rip...

11:18am: System is spewing out a short signal. Let 'er rip...

Thursday, February 17, 2011

Sell

3:55pm: The system is generating a SELL signal. No short position will be opened.

1:40pm: I spoke too soon. The odds of a short signal developing have increased to about 25%... Will update prior to the close.

1:10pm: There is a slight chance of a "sell" signal today, though not to be confused with a "short" signal, where there is almost zero chance. I doubt either one of those will come to fruition, but I will update later. For now it's a hold.

Wednesday, February 16, 2011

Hold

3:07pm: Hold signal is expected. Holding long position....

12:33pm: We lost the short signal, so now it's a toss up between "hold" and "sell". Will update later...

10:14am: I know it's very early in the trading day, but if they SPX maintains these gains, we'll see a short signal into the close...

12:33pm: We lost the short signal, so now it's a toss up between "hold" and "sell". Will update later...

10:14am: I know it's very early in the trading day, but if they SPX maintains these gains, we'll see a short signal into the close...

Tuesday, February 15, 2011

Buy signal

9pm: A buy signal was confirmed today. The first trade of the month was a loser of -2.98%. :-/

3:50pm: A buy signal is a lock. ...closing my short for a loss and taking a partial long position.

Morning post:

I may get a buy signal this afternoon. It's about a 50/50 chance... I'll post prior to the close to confirm.

3:50pm: A buy signal is a lock. ...closing my short for a loss and taking a partial long position.

Morning post:

I may get a buy signal this afternoon. It's about a 50/50 chance... I'll post prior to the close to confirm.

Monday, February 14, 2011

Hold

While I try not to bias myself toward being a bull or a bear (I just do what my system says), since I'm still partially short, I will share a tweet I received that offers us shorties some hope...

TradingTheOdds: w/ $SPX at a 52-week high on the last and 1st session of the week before opex, $SPX closed at a lower level on opex on the last 7 occurr. $$

Otherwise, no changes today. I'm getting a hold signal.

Friday, February 11, 2011

Hold

A sell signal was just missed. Not that it matters however, since the system is short. 1330 SPX should provide some resistance and I suspect we'll see some type of retracement over the next week or two. Who knows though, the game is rigged w/ POMO so we could just keep trucking to 1400.

Thursday, February 10, 2011

Wednesday, February 9, 2011

Hold

4 pm: Hold signal confirmed...

12:46pm: As of this early afternoon, the signal is to hold the short position. Looking forward, I see about a 50% chance the hold signal continues to the close... a 25% chance we get a cover signal to close out the short position, and a 25% chance of a cover and buy signal where the system covers and immediately goes long.

Will update later...

12:46pm: As of this early afternoon, the signal is to hold the short position. Looking forward, I see about a 50% chance the hold signal continues to the close... a 25% chance we get a cover signal to close out the short position, and a 25% chance of a cover and buy signal where the system covers and immediately goes long.

Will update later...

Tuesday, February 8, 2011

Short confirmed!

3:59pm: Short signal confirmed. Short at will...

Earlier post:

The recent strength of the market this afternoon, in concert with the gradually sinking VIX is helping to produce a short signal. I will update just prior to the close to confirm...

Earlier post:

The recent strength of the market this afternoon, in concert with the gradually sinking VIX is helping to produce a short signal. I will update just prior to the close to confirm...

Monday, February 7, 2011

Hold, yet again...

With resistance seemingly being broken to the upside, the rally should have more legs. Hopefully a buy signal comes sooner than later. The more extended the market gets the more risk one faces going long here.

Friday, February 4, 2011

Hold

9pm: The official signal today was a "hold". The system has taken no position yet this month. Despite the hold signal, I added to my short position, doubling it in fact with another purchase of TZA at 14.30. I'm now averaged in at 14.35 and my position is not so small anymore. If the first half of the week doesn't provide a small pullback, I may be stuck holding it until the 2nd half of February, when seasonality suggests the market may not perform so well.

Thanks to Tom at TSPTalk.com for the chart, and sentimentrader as well. Speaking of sentimentrader, for those not subscribed to his tweets, he made this observation via twitter this afternoon: 80% of the time when $SPY closed at a 52wk high on Payroll Report day, it had a lower close within 3 days.$$

Granted, anyone short is fighting the fed and their POMO right now, but almost all the data I'm looking at suggests a pullback (at least a small one) will occur sometime this month. If it materializes, I'll be ready.

~~~~~~~~~~~~~~~~~~~~~~~

1:30pm: With the recent spike upward to near new highs, I am getting a sell signal. Not to be confused with a short signal, as there is too much risk for shorts. Obviously the system has no long position, so it's the same as a hold. But if someone was considering lightening up on their long position, today may be the day to do it. Sometimes NFP days have the tendency to be a turning points.

12:24p:

Ok, so much for that big move I was blabbing about yesterday. I should know better by now than to make that type of comment. Anyway, as for the system, it's close to a buy signal, but it is dependent on the VIX, and right now the VIX is saying... "no buy".

So unless something happens, another hold signal will be produced (no chance of a short signal, btw) and a buy signal will have to wait until next week.

As for my short position, I'm still holding out for TZA = 15. :)

I will update later if anything interesting happens this afternoon.

Thanks to Tom at TSPTalk.com for the chart, and sentimentrader as well. Speaking of sentimentrader, for those not subscribed to his tweets, he made this observation via twitter this afternoon: 80% of the time when $SPY closed at a 52wk high on Payroll Report day, it had a lower close within 3 days.$$

Granted, anyone short is fighting the fed and their POMO right now, but almost all the data I'm looking at suggests a pullback (at least a small one) will occur sometime this month. If it materializes, I'll be ready.

~~~~~~~~~~~~~~~~~~~~~~~

1:30pm: With the recent spike upward to near new highs, I am getting a sell signal. Not to be confused with a short signal, as there is too much risk for shorts. Obviously the system has no long position, so it's the same as a hold. But if someone was considering lightening up on their long position, today may be the day to do it. Sometimes NFP days have the tendency to be a turning points.

12:24p:

Ok, so much for that big move I was blabbing about yesterday. I should know better by now than to make that type of comment. Anyway, as for the system, it's close to a buy signal, but it is dependent on the VIX, and right now the VIX is saying... "no buy".

So unless something happens, another hold signal will be produced (no chance of a short signal, btw) and a buy signal will have to wait until next week.

As for my short position, I'm still holding out for TZA = 15. :)

I will update later if anything interesting happens this afternoon.

Thursday, February 3, 2011

Wednesday, February 2, 2011

Hold again...

Neither a buy nor short signal was generated. I continue to hold my small short position.

Tuesday, February 1, 2011

2/1: Hold

4pm update: One of my indicators, which by itself isn't enough to produce a short signal, is indicating the market is overextended and favors a small pullback or consolidation period before possibly continuing higher. I grabbed some TZA at 14.40 as no shares of TNA were available for shorting. Hopefully we see some type of retracement the next few days. I don't expect much downside.

Earlier post...

The system will remain on the sidelines again with another hold signal. Meanwhile, I'll be establishing a short position sometime today, simply on a hunch. Since it is against the recommendation of my system, it will be a small short position.

Earlier post...

The system will remain on the sidelines again with another hold signal. Meanwhile, I'll be establishing a short position sometime today, simply on a hunch. Since it is against the recommendation of my system, it will be a small short position.

Subscribe to:

Posts (Atom)